A Will is an essential legal document that ensures your estate will be distributed according to your wishes in the event of your death. Despite its importance, many people still have not prepared a Will – potentially leaving the future of their estate in jeopardy.

Drawing up a Will may seem daunting, especially if you have complex financial arrangements. Thankfully though, you do not have to go through it alone. Here is our guide to making a Will in the UK.

Why Make a Will?

Even if you feel that you have a simple estate that’s easy to manage, it is still essential that you make a Will. There are several reasons for this, which include:

- If you die without a Will, your estate will be shared out according to set rules (known as intestacy). These rules dictate how your money and possessions will be allocated, meaning they may not be distributed in the way you want.

- Your partner will not be able to automatically inherit from you if you are unmarried or haven’t registered a civil partnership

- You will need to make arrangements for your children if they are orphaned as a result of your death

- It may be possible to reduce your Inheritance Tax (IHT) liability, ensuring that more of your money will be able to be distributed to your loved ones.

Whether this will be your first time setting up a Will, or you already have one in place, it’s also essential to ensure that your document is up to date and reflects your current circumstances. If you do not, then you run the risk of your assets going to somebody you do not want – for example if you die while going through a divorce and you haven’t changed your Will, your former partner will be the main benefactor of your estate.

How to Make a Will

A Will can technically be made on any sheet of paper and in any format. As long as it is valid, signed by you (the testator) and witnessed as the law requires, it should ensure that your estate will be distributed according to your wishes. There are two main ways to write your Will, which are to try and do it yourself, or consult a solicitor or Will writing service.

Making a Will yourself may be tempting, especially given the fact that it is the much cheaper option. However, doing so is fraught with danger, and could lead to your wishes being challenged after your death. The main risks associated with are:

Validity

For your Will to be valid, it must be:

- Made in writing

- Made by a person over the age of 18 and of sound mind

- Signed by the testator in the presence of two witnesses

- If the testator is unable to sign it, it must be done by a person nominated by the testator and in their presence

- Signed by the two witnesses, in the presence of the testator, after the document has been signed by the testator themselves

With so many steps to carry out, it is quite easy to make a mistake. Even the smallest of errors could make your Will invalid and open to challenge, meaning your estate could be divided by the rules on intestacy instead of your own wishes.

Lack of Clarity

Because a Will is such an important document, it is essential that your wishes are outlined as clearly as possible. If they are not and a beneficiary is for some reason unhappy with what you have bequeathed them, they could challenge your estate. Such contests can last for up to 12 months and can cost thousands of pounds to resolve – something that can easily be avoided.

The cost of challenging a Will due to lack of clarity may also come out of your estate, meaning there will be less money to be passed on to your beneficiaries. In other cases, the person contesting your wishes may be forced to pay.

Either way, while you are potentially saving money in the short-term, you could be setting yourself up for a much larger expense further down the line. This may end up being too big of a risk to take.

Missing Important Items

The first major challenge you’ll face when trying to make your own Will is to identify everything you own. If you miss something out, who knows where it will end up.

This is especially true for an item that may not hold much (or any) monetary value, but is sentimental for somebody else. An object of this nature could quite easily slip under the radar.

Lost Tax Efficiency Opportunities

One of the main advantages of making a Will is the chance to minimise your Inheritance Tax (IHT) liabilities. Choosing to prepare your own Will, however, means you will have to know this complicated legislation inside out if you want to enjoy all of the benefits.

Unless you are a tax professional, it’s highly unlikely you will be able to do this perfectly. This means you will probably miss out on a lot of savings – thereby reducing the amount of money you are able to bequeath to your loved ones.

Losing Your Will

This one may seem obvious, but we all accumulate a lot of paperwork over time – and your Will may end up getting swallowed up by a mass of documents. If your Will cannot be found, it may be assumed destroyed by a Court – meaning your estate will not be divided according to your wishes.

To avoid this, your executor(s) will have to somehow prove that this is not the case and your Will is still valid. This is likely to be an extremely time-consuming exercise and something that can easily be avoided.

As you can see, while drawing up your own Will may seem like a quick and easy option, it could cause many trials and tribulations further down the line. Using a solicitor or Will writing service can avoid all this, as they know exactly what questions to ask, all of the ways to maximise your tax efficiency and are able to draw up a clear and concise document that ensures your wishes will be adhered to.

What’s more, a solicitor is a licensed professional, meaning if the worst happens and something does go wrong, there are steps you can take to rectify the matter. These options are not available if you do it yourself or hire a Will writing service, meaning you get an extra layer of security by using a solicitor.

What to Include in Your Will

There are several major points to consider and include when putting your Will together. These include:

- A full account of your possessions: be sure to list all the property, savings, personal and occupational pensions, shares, insurance policies and bank/building society accounts.

- Who will benefit from your Will: make a record of who you want to give your assets to (the beneficiaries) and what you want them to receive. You could also think about any money you wish to donate to charity.

- Guardianship of minor children: decide who should look after your children in the event they will be orphaned by your death.

- Who is responsible for carrying out your wishes: outline who will be in charge of sorting out your estate after your death (known as the executors).

- Residual Gifts: in the event that you have omitted to mention anything from your Will, list a beneficiary who will receive anything you own that has not otherwise been distributed by your Will.

Important Roles

Throughout the course of setting up your Will, there are several important roles that you should be aware of. These are:

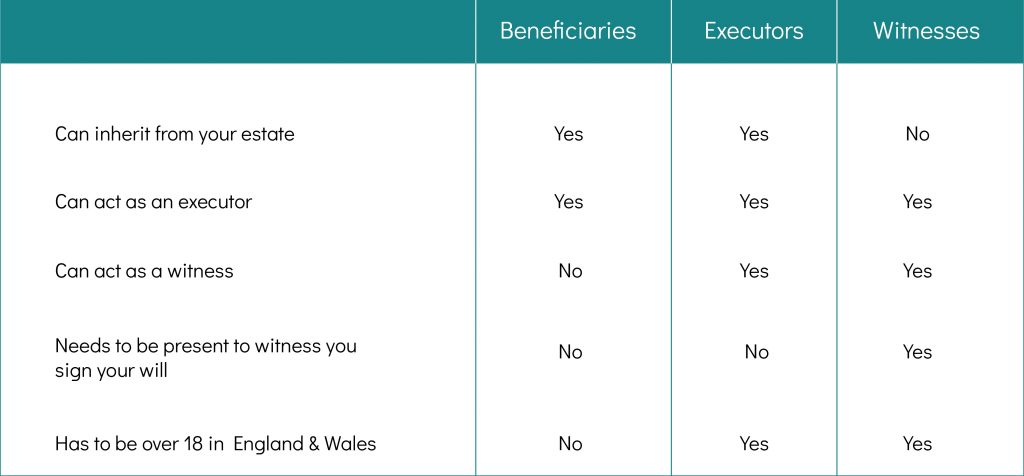

Beneficiaries

As mentioned briefly earlier, the beneficiaries are the people you want to inherit your possessions. You can nominate as many beneficiaries as you wish and, as long as your document is valid, they will receive whatever items you bequeathed to them. A beneficiary can either be a person or a company, including charities.

Executors

These are the people who are responsible for carrying out your wishes after your death. They will have to gather your estate, deal with paperwork and debts, plus arrange the funeral. Your executors will also be the ones who ensure your beneficiaries are paid.

You are able to nominate up to four people to act as your executors, with some common options being your relatives and friends, banks, solicitors or accountants. It is a good idea to name several people so you can ensure somebody will be available to carry out your wishes. You should also be sure to only nominate people you can trust, since being an executor carries a great deal of responsibility.

Witnesses

In order for your Will to be valid, it must be witnessed by two people over the age of 18 in England and Wales, or one person over 16 if you’re in Scotland. All of your witnesses must be present when you sign the document, or your Will could be deemed invalid.

Breakdown of Responsibilities

You will find that many of these people will have stipulations that overlap. For example, a witness can also act as an executor but cannot be a beneficiary of your estate. This table outlines everything you need to know.

Get the Right Support

With so much at stake, it is essential that you get expert and dependable support when setting up a Will. Doing this will ensure that you can have complete peace of mind that everything is being taken care of and your wishes will be adhered to.

This is where Shams Williams can help. We have amassed years of experience in setting up Wills and are committed to ensuring that everything is taken care of, so you don’t need to worry.